Cost Segregation Study – What Is It and How Can It Help You Get the Most Out of Your Next Building Project

When building a commercial structure – either for your own portfolio or for your client’s – the actual construction may be the most visible part of the project, but really, it’s just part of the story. To get the most from your investment, both immediately and down the road, a truly successful build requires careful planning in terms of construction logistics, materials procurement, total cost of ownership analysis and strategic financing. But these days, financing involves much more than merely securing a loan and staying within budget. The tax implications of a commercial real estate investment that is large in size and scope are also an important consideration. This is where the cost segregation study comes in.

What Is A Cost Segregation Study and When is the Ideal Time to Execute?

A cost segregation study has to do with property depreciation and the strategies involved in improving cash flow through the structuring of that depreciation over time. The building itself is an asset that will depreciate, but many of the building’s components also depreciate, and their reductions in value can occur on independent schedules. The best time to conduct a cost segregation study is at the beginning of the project in order to get a clear picture of the asset as a strategic investment.

What Is Depreciation?

Depreciation has to do with the reduction of a real estate asset’s value as it ages. The loss in value can be deducted from tax liability over the course of five, seven, fifteen, or thirty-nine years and can help a building owner recover a percentage of the costs of construction. Depreciation offsets the reduction of asset value over the life of the property, but deciding how and when to depreciate assets takes careful planning. When done right, it can help improve cash flow in the short term by strategically lowering tax liability and helping building owners recover the initial cost of the investment sooner.

Straight Line VS Accelerated Depreciation

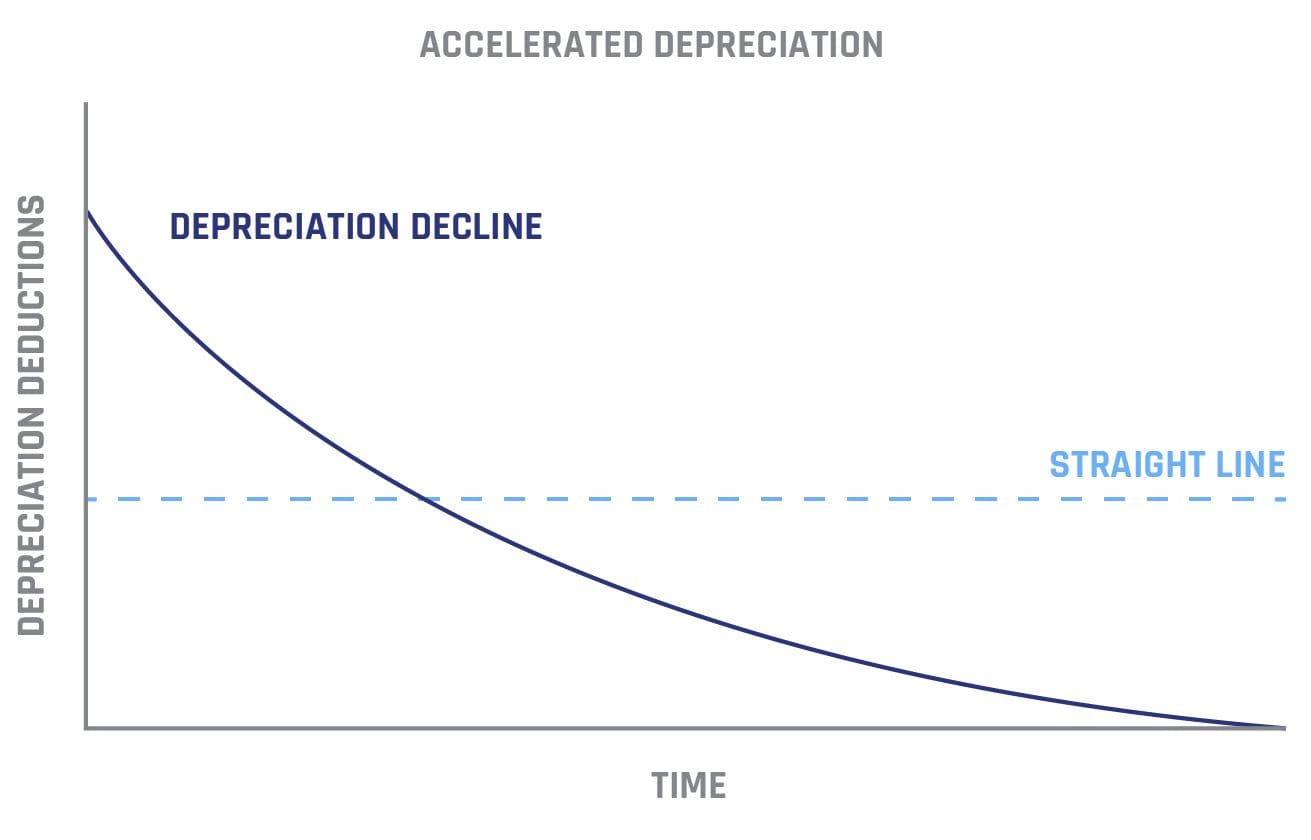

Straight-line depreciation is the method of deducting the loss of a building asset’s value evenly over its lifespan (the IRS has determined this to be thirty-nine years). Accelerated depreciation, on the other hand, is a method of deducting the loss of a building component’s value at a faster rate. This allows building owners to lower their tax liability in the immediate years following the building’s construction in order to recover the cost of building sooner.

The Cost Segregation Study

The cost segregation study helps create a clear picture of the types of building assets that qualify for accelerated depreciation. Generally speaking, a commercial building is considered “real property” and is eligible for the straight-line deduction of thirty-nine years. Real property includes the permanent aspects of a building’s construction such as walls, windows, HVAC systems, etc. “Personal property” on the other hand is what the cost segregation study is concerned with, and it includes the less permanent aspects of the building’s construction.

“Personal Property” Building Components Eligible for Accelerated Depreciation:

- Roofing

- Electrical and Plumbing Components Necessary for Operating Specialized Equipment

- Wall and Floor Coverings

- Lighting

- Etc.

Although tax depreciation is, fundamentally, an accounting concern, in order to fully understand the potential benefits, a building engineer or construction-side segregation expert should weigh-in to be sure no stone is left unturned. An expert with first-hand knowledge of the project will likely know better than anyone the extent of the opportunity.

Fleming Construction’s Cost Segregation Experts Understand Depreciation and Consider Its Implications from Day One

The Fleming Construction team of cost segregation experts helps clients get the most financial benefit from their projects and provide these insights upfront so that the tax advantages and disadvantages of certain building strategies are known from the very beginning. Our studies routinely identify net-present value (NPV) cash benefits worth up to 30% of the building cost in the first 5 years. This intel can be instrumental in planning cost recovery strategies, reducing tax liability, and improving cash flow for years after the building is operational.

Contact Fleming Construction to find out how we can help you get the most value out of your next commercial building project!

Read This Next:

Tulsa Construction – Check Out Some of Our Top Local Projects